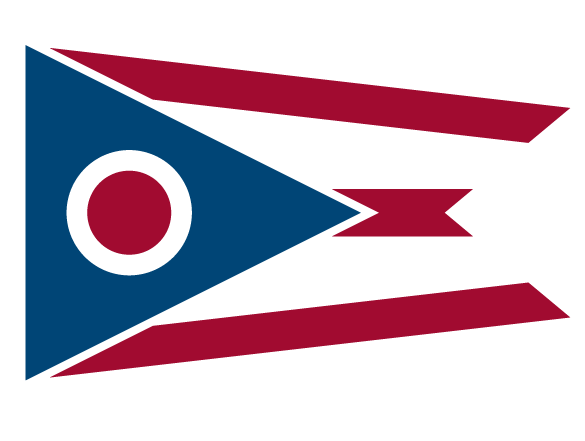

An official State of Ohio government website.

Here's how you know

An official State of Ohio government website.

Here's how you know

The site is secure.

The https:// ensures you're connecting to the official website and any information you provide is encrypted and cannot be seen by anyone else.

The .gov means it's official

Many state and federal websites end in .gov, a domain only used by government entities in the U.S.